Stock market trends are an important factor to consider when investing in the stock market. Stock market trends can be used to predict the general direction of the market and can be used to inform investment decisions. It is important to understand stock market trends and how they affect your investments. This blog will provide an overview of stock market trends, how they are analyzed, and how they can be used to inform investment decisions.

What is the Stock Market?

The stock market is a financial market that allows investors to buy and sell shares of publicly traded companies. When a company’s shares are publicly traded, it means that anyone can buy and sell them on the stock exchange. The stock market is an important part of any economy and provides an opportunity for investors to make money.

Stock Market Trends

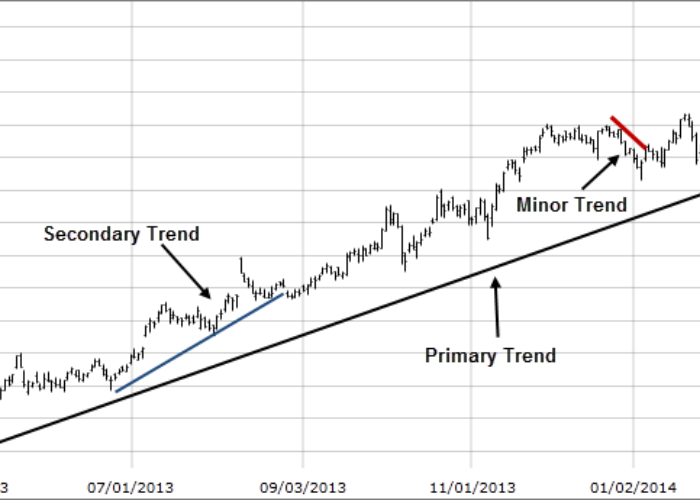

Stock market trends are the overall direction of the stock market. They can be long-term trends or short-term trends. Long-term trends can be seen over several years and can provide insight into the overall direction of the market. Short-term trends are seen over a shorter time period and are used to predict the direction of the market in the near future.

Stock Market Analysis

Stock market analysis is the process of analyzing the stock market in order to predict future trends. There are a variety of methods and tools used to analyze the stock market, such as technical analysis and fundamental analysis. Technical analysis uses charting and other methods to identify trends and make predictions. Fundamental analysis uses economic data and company information to make predictions.

Types of Stock Market Trends

There are several different types of stock market trends. These include bull markets, bear markets, sideways markets, and volatile markets. Bull markets occur when stock prices rise over a period of time. Bear markets occur when stock prices fall over a period of time. Sideways markets occur when stock prices remain level for a period of time. Volatile markets are characterized by large, sudden movements in stock prices.

Factors Affecting Stock Market Trends

There are a variety of factors that can affect stock market trends. These include economic conditions, political events, investor sentiment, and industry news. Economic conditions can have a large impact on stock prices as investors react to changes in the economy. Political events can also have an effect on the stock market as investors react to events such as elections or policy changes. Investor sentiment can also affect the stock market as investors buy and sell based on their expectations of the future. Industry news can also affect stock prices as investors react to news about individual companies or sectors.

Strategies for Investing based on Stock Market Trends

Investors can use stock market trends to inform their investment decisions. One strategy is to buy stocks when the market is in a bull market and sell stocks when the market is in a bear market. Another strategy is to buy stocks when the market is in a sideways market and sell stocks when the market is in a volatile market. Investors can also use technical analysis and fundamental analysis to identify trends and make informed decisions about when to buy and sell stocks.

Conclusion

Stock market trends are an important factor to consider when investing in the stock market. It is important to understand stock market trends and how they affect your investments. This blog has provided an overview of stock market trends, how they are analyzed, and how they can be used to inform investment decisions. By understanding stock market trends and using them to inform your investment decisions, you can make more informed decisions about when to buy and sell stocks.